Introduction to Bullish Harami Candle

In this module, we are going to discuss the Bullish Harami candle, which gives a very strong signal of a trend reversal (to uptrend). We'll show you what this looks like, its characteristics, and valid conditions for this candle.

In addition, we'll look at the psychology behind the Bullish Harami candle and discuss predictions for the future.

The first thing we want to discuss with you is what a Bullish Harami candle is.

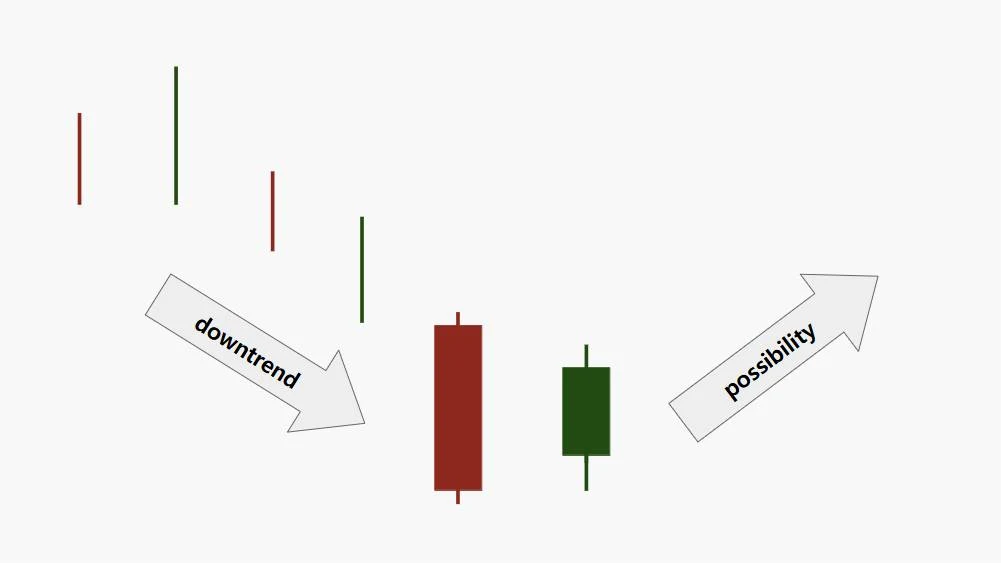

During a downtrend, a small green candle that is completely contained within the body of the previous large red candle is called a bullish harami candle.

Bullish Harami Candle Anatomy

Characteristics of an Bullish Harami candle

| Feature | Character |

|---|---|

| Formation | The pattern consists of two candles. |

| Color | The first candle is red (bearish), and the second candle is green (bullish). |

| Real Body Position | The second candle's real body is completely within the range of the first candle's real body. |

| Shadow | Shadows are typically short for both candles. |

| Shadow Proportion | The second candle has a much smaller body and shadow compared to the first. |

| Range | The range of the second candle is narrow, highlighting consolidation. |

| Volatility | Decreased volatility in the second candle, suggesting a potential trend change. |

| Trend | Typically appears in a downtrend, signaling a potential bullish reversal. |

| Momentum | Momentum shifts from strong selling to indecision, indicating a possible trend reversal. |

| Symmetry | The second candle is significantly smaller than the first, creating an asymmetrical pattern. |

| Volume | Volume might decrease on the second candle, indicating waning bearish pressure. |

Blueprint of a Bullish Harami Candle on chart

A Bullish Harami Candle occurs during a downtrend and indicates the possibility of a counter-trend, meaning a reversal to an uptrend.

Limitations of the Bullish Harami Candle

- False Signal: In volatile markets, the Bullish Harami can produce misleading signals, resulting in incorrect trade entries.

- Dependence on Confirmation: This pattern requires confirmation from other indicators or price action to validate the signal.

- Movement: The Bullish Harami usually indicates short-term reversals, not long-term price trends.

- Market View: Its effectiveness is influenced by the overall market structure and prevailing trend.

- Limited Use in Strong Trends: Less reliable in strong upward or downward trending markets, where reversals are less likely.

- Asset Variation: Success rates can vary depending on the financial instrument being traded.

- Point of View: Traders may interpret the Bullish Harami differently based on their strategy and market outlook.

- Volume Factor: Low trading volume can diminish the pattern's reliability, so it's important to consider volume as part of the analysis.

Next In Line