What is Day Trading?

Almost everyone enjoys day trading or intraday trading. In this article, we're going to explain the fundamentals of day trading.

If you're a beginner, this whole section will help you with an understanding of how to start, requirements as a day trader, what other traders are doing (their strategies), how you can develop your own strategies, what to expect from day trading, risk management and many more.

If you're not a beginner, then you may jump ahead to the next article. However, we encourage you to skim through the whole article.

The first thing that we want to cover with you is what day trading actually is?

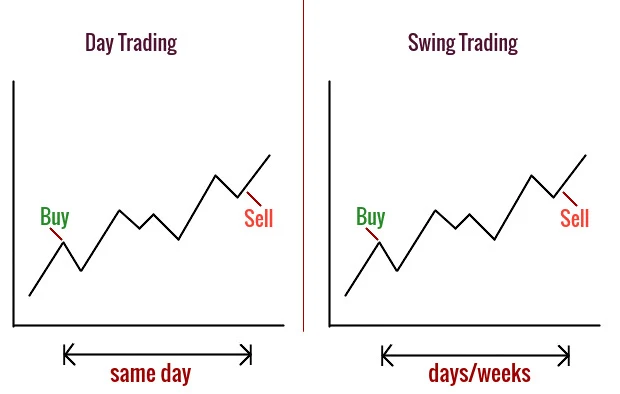

Here trades can last for a few seconds to a few hours. You're buying and selling a stock in order to turn a profit. So there's investing which is long-term buying and selling and then there's day trading which is when you're doing that buying and selling within the same day period.

Note: This section is deliberately long and you may get bored halfway but don't skip any part of the course if you're a beginner trader. On a weak foundation, you can't create an excellent building.

Requirements for Day Trading

- Enough capital

- The best broker

- Stock screener

- High-speed internet

- A community of traders

- A trading platform

- Last one, willing to learn from the market

Enough Capital: Over $25,000 is ideal if you're a resident of the United States, but you can start with as little as $1000 or less (in some countries). If you're a beginner we suggest you start off small and take it slow.

The Best Broker: A broker helps customers to buy and sell securities. You should check the role and services offered by a broker before opening an account with them. There is a lot of broker service providers are out there in the market. We suggest you choose the broker with fast order execution, providing trade on call facility, low brokerage (not that important), and also check other trader's opinions/reviews about the broker.

Stock Screener: A stock screener is very helpful to filter out and analyze securities. There is a lot of screeners available in the market. Some of them are paid and some are freely available. Check out different screeners and choose the one which suits you.

High Internet Speed: Actually, it depends on your trading style. If you're a long-term investor then it wouldn't make much difference but as a day trader or a scalper trader, where you are making quick decisions about where and when to buy or sell, in that case, you can't afford any lagging with the internet speed.

A Community Of Traders: In the financial market you should do what other traders are doing if you want to stay in the market for a long time. You should join a trader community to find a fishy market but still, you have to be at your own decision and risk.

A Trading Platform: A trading platform is a software where you can place your buy or sell order through your broker. All broker have their own trading platform but a third-party trading platform (mostly paid version) is also available with extra features and hotkeys.

Characteristics of a day trader

- Day traders aim to make a profit quickly while reducing market exposure.

- Day traders do trading for a living.

- Day traders risk their capital which they can afford to lose.

- Day traders can't be stuck in the past, they are always planning their next moves.

- Day traders search for high probability outcomes in their favor.

- Day traders don't stick to few strategies or few stocks. They look for opportunities excluding securities fundamentals.

- Day traders look for the volatility in the financial instruments.

- Day traders should avoid overtrading, it is not a way to get rich quickly.

| Day Trading | Swing Trading |

|---|---|

| Trade last within the same day | Trade last from days to weeks |

| No overnight risk | Overnight risk |

| Sensitive to news | Less sensitive to news |

| Compounding faster | Compounding slower |

| More expensive in terms of commissions | Less expensive compare to day trading |

| Requires more attention | Requires less attention |

| Not suitable for novice traders | Suitable for all, right from beginners to moderate and advanced players |

| Requires expensive software, hardware and news services | Swing trading can be done with free services |

FAQs on Day Trading

Yes. Intraday trading is also known as Day Trading.

These are the primarily reasons:

- Profit-to-loss ratios are frequently ignored.

- Fear of Loss in Trading.

- Continually switching from one technique to the next, or from one technical indicator to the next

- Selling Winners Too Soon.

- Holding Losers Too Long.

Todo list to become a profitable trader:

- Learn proper risk management.

- Use stoploss

- Understand there is no shortcut to quick earning, enjoy the process.

- Develop a trading system.

- Treat trading like a business, trade in businesses you know better.

- Trade with discipline

- Study the market.

- Don't overtrade.

- Try to catch the footprint of big investors.

- Last but not least, stay away from tip providers.

Yes, you owe taxes on the gain and this tax is higher than the tax rate assessed on long-term capital gains.

Day traders must close their positions on the same day, whether they are profitable or not. If you don't, your broker will automatically cut your stake whereas if you hold a position for more than a year then it is called Investing.