Financial Steps To Take Before Your 40

When you're in your forties, you're roughly halfway between starting a career and reaching retirement age. As you get older and closer to retirement, it gets harder and harder to undo any financial mistakes you've made.

In today's world, there are so many different distractions in our lives that we can easily overlook the importance of our financial well-being in the future.

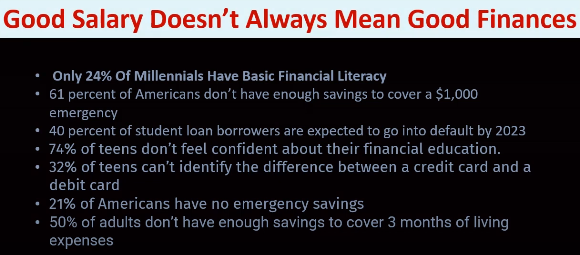

Scary Financial Statistics

Each stage of life is different and so are its financial goals. Here are 8 things you should consider to help you financially plan and build wealth in your 40s.

- Build An Emergency Fund

- Securing A Home For Yourself

- Invest in your health

- Retirement Planning

- Don't Borrow to Finance a Lifestyle

- Track Your Spending

- Plan For Your Children’s Education

- Take Calculated Risks

Build An Emergency Fund

Securing A Home For Yourself

Invest in your health

Retirement Planning

Don't Borrow to Finance a Lifestyle

Track Your Spending

Plan For Your Children’s Education

Take Calculated Risks

- Calculated risks include the following:

- Moving to a new city where there are more job opportunities.

- Returning to school for additional training .

- Accepting a new job at a different company with lower pay but greater upside potential.

- Investing in stocks with a high risk/high return.

Every stage of life mandates the establishment of an emergency fund. You may find it difficult to reach this aim in your 20s, but there is little time to lose in your 30s. An emergency savings of three to six times your present monthly income is recommended.

It's designed to assist you in dealing with unforeseen circumstances such as a job loss, a medical emergency, or the need to travel urgently, among other things. This fund is essential for your mental, physical, and financial well-being since it protects you against life's unexpected events. Start by setting up a recurring deposit and contributing to it every month if you haven't already.

Your goal should be to earn three times your current take-home pay. Once there, continue to add to the fund until you reach 6x.

If buying a house makes sense for your financial situation and location, your forties are an excellent time to get serious. It's a good idea to set aside 20% of your income for a down payment. With that amount, you will avoid paying private mortgage insurance, which is an extra cost for some homeowners and protects the mortgage company if you default on payments. Those who put down 20% when purchasing a home are exempt from purchasing this coverage, which saves you money.

When you reach the age of 40, it's a good idea to check your overall health. If you take care of yourself in your 40s, you'll have a better chance of staying healthy for the rest of your life. This not only enhances your quality of life, but it's also a smart financial decision.

Medical expenses in later life can be financially crushing, so investing in your health now, in addition to saving for retirement, will perhaps help you avoid some of those costs later.

Most people have a retirement plan in place by the age of 40, whether it's a 401(k) or another type of account.

Now is the time to take a look at your finances and figure out how much money you'll need to retire comfortably (and by when). Then do the math to see if your existing investment strategy will bring you there. If not, devise a strategy for getting there.

Borrowed funds should only be used when the profit exceeds the cost of borrowing. This could imply investing in yourself, such as for education, starting a business, or purchasing a home. Borrowing can provide the leverage you need to reach your financial goals faster in these cases.

Using credit to fund a lifestyle you can't afford, on the other hand, is a losing proposition when it comes to accumulating wealth. And the additional interest expense of borrowing raises the overall cost of the lifestyle.

Knowing how much you spend and on what helps you keep track of your spending.

You may discover that ordering in several times per week costs more than $250 per month, or that recurring charges for streaming services and subscriptions you never use are a waste of your money. If you can afford to spend hundreds of dollars per month on takeout, that's fantastic. If not, you've just discovered a simple way to save money aside from cancelling those streaming services you forgot you had.

Higher education isn’t cheap.. As a result, you must be prepared to provide for your children's long-term needs. As you approach your forties, your children will be closer to starting college and you will be closer to retiring. You must find a way to balance these complex financial objectives with the borrowings required to achieve them. Mutual fund SIPs are one of the best ways to invest for your children's education needs. You could also consider investing in assets that appreciate in value, such as land.

Taking calculated risks when you are young can be a wise long-term decision. You will make mistakes along the way, but you will have more time to recover from them if you are young.

While this is a lengthy list of tasks, you are not required to complete them all at once. You're probably already on track with many of these financial steps, but taking into account all of them is a good place to start when it comes to building wealth in your 40s.