Basics of Investing and it's importance

Why should one invest?

Before we address to the question, first let's start with a hard fact-based reason through an example :

To understand whether one should invest or not we are going to discuss two scenarios:

Scenario Ⅰ : You are the one who decided to invest.

Scenario Ⅱ : You are the one who decided to keep their cash idle.

Now in the 1st Scenario, you choose to invest. Let us assume that your initial investment amount is $10,000 and every next year you are going to add on some surplus cash which is let say 15% more than the previous year in investment amount.

| 1st year investment | $10,000 |

| 2nd year investment | $11,500 (15% extra of $10,000) |

| 3rd year investment | $13225 ( 15% extra of $11,500) and so on till 20th year |

Let's have a look at price chart of two different markets over the span of 20+ years.

Statistically, by looking at past performances in the financial market we can say with no hesitation that you can grow the money from 10% - 15% per year over the long term.

There have been some crashes, black days, and pullbacks. But overall, they have gone up. Now let us assume that the money you are going to invest in the financial market, gains roughly 12% per year over 20 years period of time.

To get a better understanding of how's your money working for you during the span of 20 years, look out at the table below:

| Year | Invested Amount($) | Retained Cash Invested @12% |

|---|---|---|

| 1 | 10,000 | 96,463 |

| 2 | 11,500 | 99,047 |

| 3 | 13,225 | 1,01,700 |

| 4 | 15,208 | 1,04,419 |

| 5 | 17,490 | 1,07,221 |

| 6 | 20,113 | 1,10,090 |

| 7 | 23,130 | 1,13,039 |

| 8 | 26,599 | 1,16,065 |

| 9 | 30,588 | 1,19,170 |

| 10 | 35,176 | 1,22,361 |

| 11 | 40,452 | 1,25,638 |

| 12 | 46,519 | 1,29,001 |

| 13 | 53,496 | 1,32,454 |

| 14 | 61,520 | 1,36,001 |

| 15 | 70,748 | 1,39,644 |

| 16 | 81,360 | 1,43,384 |

| 17 | 93,564 | 1,47,225 |

| 18 | 1,07,598 | 1,51,167 |

| 19 | 1,23,737 | 1,55,216 |

| 20 | 1,42,297 | 1,59,373 |

| Total investment in 20 years | $10,24,320 | |

| Total income after 20 years | $25,08,678 | |

Your initial investment is $10,000/- which when invested at 12% per annum for 20 years yields $96,463/- at the end of the 20th year.

Again next year you invested $11,500/- at 12% per annum for the next 19 years yields $99,047/- and so on. In the last year of your investment plan, you invested $1,42,297/- for one year at 12% per annum yields $1,59,373/- at the end of the 20th year.

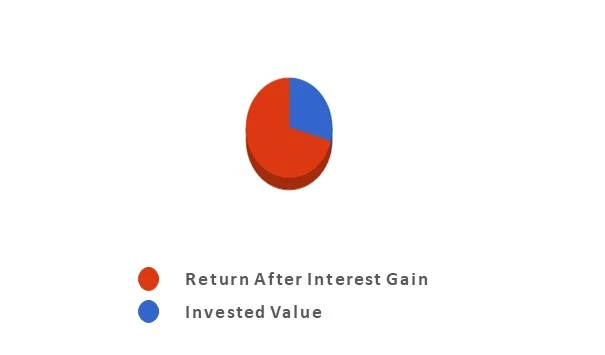

In the below bar chart each bar is representing the invested value (blue color) and red one is indicating total amount after interest gain.

In this scenario with the surplus cash, you can make a decent amount of money in 20 years. This is an astonishing 2.4x times the regular amount you are going to save.

Now let's discuss the 2nd scenario where you are going to keep your surplus cash idle meaning your money is doing nothing simply sitting on the bench. In this situation, after 20 years of hard work you have accumulated $10,24,320

Here you should aware of one important point that each year your cost of living is likely to go up more or less by 8% year on year(considering inflation rate and other factors). With the intention not to work after 20 years and with $10.24 lakhs, you can survive roughly about 8-9 years of post-retirement life. After that what would you do? Rethink!

We hope that you can imagine this scary situation( scenario Ⅱ ). If you are reading this article that means somehow you're interested in investing.

To keep this article short, we have discussed only one type of financial instrument. Likewise you can observe that other assets class are also giving the good return over the long term.

Now here comes the next question in your mind. Where to invest? How to invest? How much to invest? Is there any risk? and many more.

But you need not worry about all these questions as we are going to all your question one by one throughout this section. We will discuss thoroughly assets class that suits the individual's risks and return temperament.

This is one of the many examples of why should one invest, there are many more reasons which are as follows:- Potentially high returns.

- Beats the effects of inflation.

- Diversification.

- Compound the interest.

- Simple and flexible.

- Invest in stocks for tax-free profits.

- To create an alternative source of income.

- Investing makes your money to work for you.

- You don't need to be a 'Genius' to invest in stocks.

- It requires as little amount as buying an "Ice cream".

- One needs to invest to make a provision for an uncertain future.